can you opt out of washington state long-term care tax

Lets assume for the moment that you dont opt-out of the Washington long-term care tax program before the December 31 2022 deadline. The move follows a frenzy of interest in the costly insurance policies prompted by a November.

What S Next For Beleaguered Wa Long Term Care Program Crosscut

Benefit is 100day up to a 36500 maximum lifetime benefits.

. Turns out they were a bit premature. Washington states Long-Term Care Trust Act is set to take effect at the beginning of 2022 and the only time to opt out of the new tax is fast approaching. Monday is the deadline to have your private long-term care insurance plan in place in order to opt out of Washingtons new payroll tax.

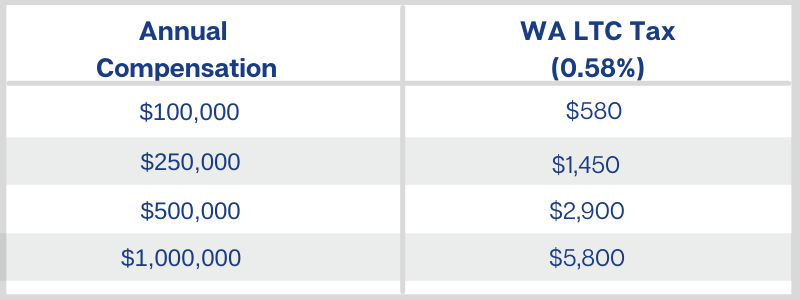

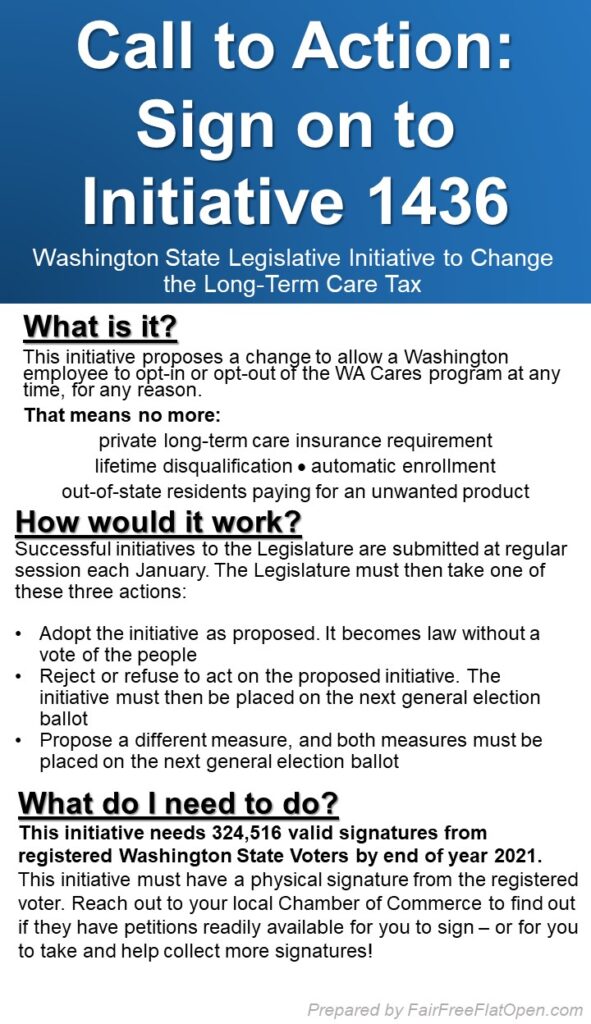

Self-employed will be able to opt-in. People who work in Washington will pay 058 of their earnings into the Washington Cares Fund. For example if someone earns 100000 they will.

On January 27 2022 Washington Governor Jay Inslee signed House Bills 1732 and 1733 delaying and amending the Washington Cares Act often referred to as the Long-Term. The Washington Long-Term Care Act is still the law. 26 2021 inviting passersby to come in and ask questions about.

If you purchased a long-term care insurance policy prior to November 1 2021 then you have the golden ticket to remain exempt. A sandwich board sits outside an insurance brokers office in Seattles Fremont neighborhood on Aug. No matter your age or health status the WA Cares Fund provides affordable long-term care coverage.

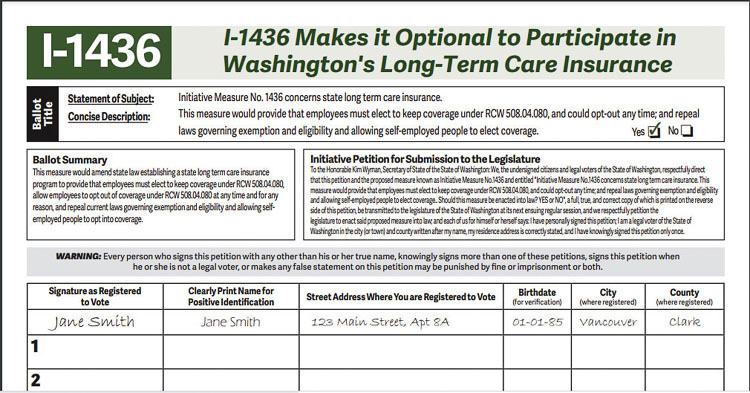

Long-term care insurance companies have temporarily halted sales in Washington. To opt out you will need to purchase your own long-term care insurance policy as well as file a waiver application with the state between October 1 2021 and December 31 2022 for. Here is a summary of the bill.

You have one opportunity to opt out of the program by having a long-term care insurance policy in place by November 1 st 2021. Opting out of the tax must be done by November 1 2021 and you must buy qualified private long-term care. Washington has adopted a first-of-its-kind law that both provides a new long-term care benefit and pays for the new benefit with a new tax collected by employers.

To qualify for an exemption you must be at least 18 years old and have proof of an eligible LTC. After months of backlash governor Jay Inslee recently signed a pair of bills to delay and amend the tax for Washingtons long-term care. 1 to opt out of the states long-term care.

Under current law Washington residents have one opportunity to opt out of this tax. How do I opt out of WA cares. If you meet the opt-out criteria and purchased your LTC policy prior to Nov 1 2021 you have until December 31 2022 to opt-out of the tax.

It will allow you to opt out of the tax as long as the coverage qualifies and you obtain the opt out in accordance with Washingtons requirements. The video below will walk you through. What You Need to Know.

To qualify for the benefit the person. Applications are available as of October 1 2021. Funded through a payroll tax of 058.

Private insurers may deny coverage based on age or health status. In that case the tax will be. The window to apply for an exemption.

How To Opt Out Of The Washington State Cares Fund For Long Term Care Insurance And What It S All About

Thousands Of Washingtonians Look To Opt Out Of Long Term Care Insurance Tax Business Daily News Mcknight S Senior Living

Ltca Long Term Care Trust Act Worth The Cost

Repealing The Unpopular Long Term Care Insurance Program And Regressive Payroll Tax Washington State House Republicans

I 1436 Will Give Workers Choices On State S Long Term Care Insurance Program Clarkcountytoday Com

Wa State Long Term Care Insurance Tax Exemptions Information

Why Some Plan To Opt Out Of New Wa Long Term Care Insurance Crosscut

Washington State Long Term Care Tax How To Opt Out

Want To Opt Out Of Washington S New Long Term Care Tax Good Luck Getting A Private Policy In Time Northwest Public Broadcasting

Wa State Long Term Care Insurance Tax Exemptions Information

Did You Receive A Long Term Care Email From Your Employer Here S What It Means To Opt In Or Opt Out Geekwire

Washington State Long Term Care Tax Wa Cares Fund

Washington Cares Payroll Tax Opt Out Is Now Open Coldstream Wealth Management

Washington State Long Term Care Tax Avier Wealth Advisors

Opening Day Woe And Initiative Weal Washington State Ltc Opt Out A Bust But Initiative Gathers Steam Fair Free Flat Open

Kris Johnson Long Term Care Program Must Be Pushed Back

Repealing The Unpopular Long Term Care Insurance Program And Regressive Payroll Tax Washington State House Republicans

State Needs To Opt Out Of Its Long Term Care Tax Vancouver Business Journal